At the recently concluded G20 summit, Indonesia's new president Prabowo Subianto announced that Indonesia has pledged to build more than 75GW of renewable energy projects in the country and stop operating coal-fired power plants and all fossil fuel power plants in the next 15 years. In addition, the country also plans to achieve net zero emissions by 2050, mainly relying on renewable energy and biodiesel. During the COP29 meeting, Indonesia's Special Envoy for Energy and Climate Change Hashim Djojohadikusumo said that the government plans to add 100GW of energy capacity by 2040, of which 75% will come from renewable energy, including 25GW of hydropower, 27GW of solar, 15GW of wind, 7GW of geothermal energy and 1GW of biomass. PT PLN, Indonesia's state-owned power company, has been given the responsibility of implementing 75GW of renewable energy capacity. This batch of projects requires an investment of at least US$235 billion, including the construction of transmission lines from the islands to demand centers. Under the Indonesia Just Energy Transformation 2023 Plan (JETP), Indonesia plans to install around 265GW of solar PV capacity to ensure net zero emissions in the power sector by 2050.

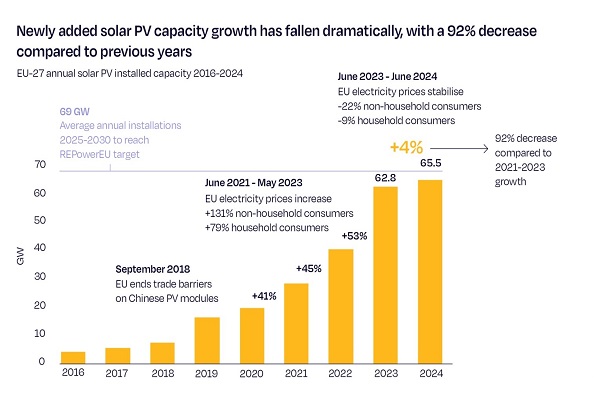

Solar PV additions in the European Union are forecast to reach 65.5GW in 2024, according to trade association SolarPower Europe’s (SPE) latest report. After years of rapid growth with double-digit increases from previous years, Europe is facing a 92% slowdown in solar growth compared with the growth between 2021 and 2023. Last year was marked by a record 62.8GW of solar capacity additions, while this year’s growth from 2023 only amounts to 4.4% – the lowest market growth since 2017. The slowdown was not surprising for SolarPower Europe. “Following the solar boom during the gas crisis, the urgency of going solar has waned for citizens as their bills normalise,” the EU Market Outlook for Solar Power report said. “Developers face challenges for different reasons. The energy system has not kept up with the solar growth curve, and building bankable utility-scale solar becomes more difficult as grid and flexibility bottlenecks tighten.” SPE’s data showed the residential rooftop market has seen a nearly 5GW decrease from 2023 with 12.8GW of capacity additions in 2024. This decrease is partially down to the removal of incentives for rooftop solar (for instance, the Netherlands will remove its net metering scheme for residential solar by 2027) which saw decreases in residential solar in Germany, Austria, Italy, Poland, the Netherlands, Belgium, Sweden, Spain, and Hungary. The slower growth of solar PV in 2024, along with residential solar stumbling, has affected the biggest European markets too. Half of the top 10 biggest solar markets in 2024 have seen a drop in capacity additions from the previous year. Spain, Poland, the Netherlands, Austria and Hungary have seen their solar PV market contract since the end of the energy price crisis and policymakers failing to offer regulatory stability to maintain investment appetite in solar. The Netherlands has seen the steepest drop, with an annual decrease of 1.8GW from 2023, whereas the growth in the other five markets has been “modest”, according to the report. France saw the biggest increase, with 1.5GW added in 2024. Germany (with 16.1GW added in 2024) continues to be the largest market in the European Union for solar PV, by Spain (9.3GW) and Italy (6.4GW). Challenges ahead for solar PV Looking ahead, the report forecasts continued single-digit growth between 3-7% from 2025-2028. SPE said this would still allow the EU to reach its 2030 solar PV target of 750GW as it projects 816GW of installed solar PV by the end of the decade. However, the trade association warns that Europe could still miss the mark by 100GW if it follows the wrong path. In the report, SPE outlined several challenges looming for the solar industry in the coming years. As mentioned earlier, the residential market is poised to continue its downward path. However, the report highlights an increased interest in balcony solar deployments. In Germany alone over 220,000 systems – around 800W – were added in the first half of 2024. Inflexible ...

Brazil installed 2.3 GW of large-scale solar and 4.5 GW of distributed-generation PV in the first six months of this year. New figures from Brazil's energy regulator, ANEEL, show that the country achieved an impressive 6.8 GW increase in PV generation capacity in the first half of 2023. Within this growth, 2.3 GW emerged from 61 newly established large-scale PV plants, while an additional 4.5 GW was contributed by distributed-generation solar, involving PV systems under 5 MW in size. It remains unclear whether these statistics include the 1.2 GW Janaúba solar complex, which was unveiled in July by Elera Renováveis in Janaúba, Minas Gerais. Brazil reached 32 GW of cumulative installed PV capacity at the end of June, constituting approximately 14.7% of the nation's overall installed capacity, which currently stands at 194.38 GW. Related Tages: Metal Roof Mounting, Pitched Roof Mounts, Solar Racking Solution Fastensol - Your Solar Partner!

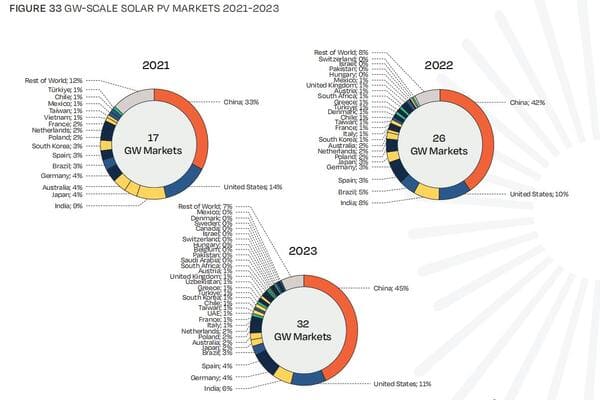

The demand in the global photovoltaic market continues remain strong in 2023. China is the largest application market for photovoltaics and the largest manufacturing base in the world. Globalization is also one of the main directions for the future development of Chinese photovoltaic enterprises. China's photovoltaic industry chain is complete, covering silicon materials-silicon wafers-cells-modules, and has the advantages of industrial linkage. At the same time, photovoltaic technology has a deep accumulation and a relatively solid industrial foundation. Some companies have invested and built factories overseas. In the context of global carbon neutrality, many countries and regions regard the development of renewable energy including photovoltaics as an important part of their carbon neutrality path. Driven by breakthroughs in renewable energy technology and policy tools, the global photovoltaic market has maintained a good momentum of development. The China Chamber of Commerce for Import and Export of Machinery and Electronic Products released the "White Paper on the External Development of China's Photovoltaic Industry" this year, pointing out that in the next 10 years, the global photovoltaic application market will still maintain a high demand. It is recommended that Chinese photovoltaic enterprises actively participate in the formulation of international standards for the photovoltaic industry; guide and encourage enterprises Increase investment in research and development, improve awareness of intellectual property rights strategy; establish a green and low-carbon certification standard system for photovoltaic products, and promote the docking of green and low-carbon trade rules and mechanisms at home and abroad. Fastensol- Your Solar Partner!

Nigeria mainly uses fossil fuels and hydro in its 4 GW power generation fleet. It has been estimated around 30 GW of capacity would be needed to fully cover its population of 200 million people. The International Renewable Energy Agency (IRENA) estimated Nigeria had 33 MW of grid-connected solar at the end of 2021. With solar irradiance ranging from 1.5 MWh/m² to 2.2 MWh/m², why does the country remain shackled by energy poverty? IRENA has estimated renewables could meet 60% of Nigeria’s energy demand by 2050. Thermal power stations generate around 70% of Nigeria’s electricity today, with hydro providing most of the remainder. Five main generation companies (GenCos) dominate and the Transmission Company of Nigeria is the sole transmission entity, responsible for the development, maintenance, and expansion of the transmission network. The distribution sector has been completely privatized. Power produced by the GenCos is sold to Nigerian Bulk Electricity Trading Company (NBET) which is the only bulk trader of electricity. It buys electricity from the GenCos through power purchase agreements (PPAs) and sells to private distributors through vesting contracts. This structure ensures that the generating companies get a guaranteed price irrespective of what happens on the distribution side. There are fundamental problems with the system which also affect the adoption of solar technology as a part of Nigeria’s energy mix. due to policy uncertainty and lack of grid infrastructure,the lack of lender trust in the Nigerian power market also stems from fundamental issues with the electricity grid, especially with regards to its reliability and flexibility. That is why most lenders and developers require guarantees to safeguard their investments. Much of Nigeria’s grid infrastructure is unreliable. Nigeria is a potentially big market for solar mini-grids as there are towns and communities without any connection to the grid. Mini grids are also an opportunity for developers and financiers to serve those without access to electricity, and for the development of captive solar power facilities for heavy energy consumers, such as mines, to ensure their own reliable and affordable power capacity. There is also opportunity for development of energy storage solutions to stabilize local grids. Tapping Nigeria’s PV potential will require a synchronous effort between the government, developers, lenders, and consumers. And time is of the essence now that many countries are in the race to net zero. Decarbonizing power infrastructure is key. Related Tages: Metal Roof Mounting, Pitched Roof Mounts, Solar Racking Solution Fastensol, Your Solar Partner!

A photovoltaic hydrogen production project located in North-West of China was hit by a level 13 sandstorm. A large number of solar photovoltaic brackets collapsed, photovoltaic modules were damaged to varying degrees, and some modules were completely broken. Relevant personnel said that the serious damage to the project was the result of the joint action of various influencing factors. On the day of the accident, the gust intensity reached level 13 or above, and the windy weather lasted for nearly 12 hours. At the same time, the project uses super-large photovoltaic modules, and the design of the support strength does not fully consider the wind load. The reason for this accident is that the project developer did not purchase commercial insurance, and the manufacturer usually does not purchase additional commercial insurance for the manufactured products. lead to heavy losses. In order to prevent possible losses, during the project bidding stage, some owners will specifically propose that the general contractor (EPC) be responsible for purchasing "project all risks" and clearly write it into the contract. The various components used in this incident are not the first to come out, and it should be attributed to the lack of awareness of dealing with extreme weather and safety issues. For the construction of the project, it is not only about cost reduction, but also for safe and stable operation, it is necessary to thicken the component glass, strengthen the bracket material, deepen the piling, and take into account both cost and project safety.

Data released by the Hellenic Association of Photovoltaic Companies, show that the Greek solar market installed three times more capacity in 2022 compared to 2021. Greece connected 1.36 GW of new PV capacity to the grid in 2022. Of this, 341.5 MW was connected to Greece’s transmission grid and about 1020MW was connected to Greece’s distribution grids. Given the fact that commercial net-metered system installations more than doubled that of residential systems, the Greek government wants to boost the residential segment by introducing a new generous rebate scheme aiming specifically at residential solar-plus-storage. The government said the new scheme will be published shortly, possibly before the end of March, 2023. And Greece aims to have 14.1 GW of installed PV capacity by 2030 and 34.5 GW by 2050. Fastensol- Your Solar Partner!

Economy Minister Robert Habeck, a leading member of the Greens party, noted that Germany needed to take a range of steps, including diversifying its sources of imports. "We need to admit that in the past we have been too reliant on Russian imports," Habeck told journalists ahead of a European Union meeting in Brussels. "In the medium and long term, we are going to significantly reduce the consumption of fossil fuels." Habeck's ministry plans to speed up the passage of the Renewable Energy Sources Act (EEG) through parliament so that it can come into force by July 1. The act would see Germany suspend cuts to subsidies for new solar panels on roofs this year and increase solar tenders to 20 gigawatts by 2028 from about five gigawatts now, keeping them at that level until 2035, the ministry said. Germany would also boost tender volumes for onshore wind energy to 10 gigawatts (GW) annually by 2027 from about two gigawatts now and keep them at that level through to 2035. These steps would help renewable sources account for 80% of Germany's electricity needs by 2030 and all of them by 2035, compared to a previous target to abandon fossil fuels "well before 2040", the ministry said. By 2035, Germany's onshore wind energy capacity should double to up to 110 GW, offshore wind energy should reach 30 GW and solar energy would more than triple to 200 GW. However, Habeck rejected calls for Germany to reconsider exiting coal and nuclear power in light of Russia's invasion. "Coal and nuclear are not alternatives for Germany," he said, noting that half of Germany's coal was also imported from Russia and adding that it would not be possible to keep nuclear plants online as they do not have approval to keep running. Fastensol is one of China's leading suppliers of solar mounting system. Fastensol- Your Solar Partner!

In the first half of 2020, affected by the COVID-19 epidemic, although global electricity demand fell by 3%, wind and solar power generation still increased by 14% year-on-year. Among the 48 countries and regions in the report, wind and solar power generation increased from 992 TWh in 2019 to 1,129 TWh in the first half of 2020. Compared with the first half of 2019, global coal power generation in the first half of 2020 fell by 8.3%. This is the biggest drop since 1990, following a 3% year-on-year decline in 2019. A major factor driving the decline in coal power generation is the decline in electricity demand caused by the global epidemic, but the increase in wind andsolar power generation and higher market shares are also the main reasons for the decline in coal power. Although the electricity demand caused by the COVID-19 epidemic has not yet affected wind and solar power generation. However, the global epidemic has affected the installation speed of new wind and solar power generation devices in 2020; the International Energy Agency (IEA) predicts that by 2020, the newly installed capacity of renewable energy power generation will drop by 13%, falling to the level since 2015 The lowest level. Dave Jones, senior power analyst at Ember, said: “Countries around the world are striving to build more wind spots and photovoltaic panels to replace coal power. If the global temperature rise is to be limited to 1.5 degrees Celsius, coal power generation will have to be generated every year for the next ten years. A reduction of 13%. However, despite the impact of the new crown epidemic that has curbed electricity demand as a whole, coal power generation only dropped by 8% in the first half of this year. This fact shows that we are still deviating from the energy transition track. We have a transition solution. The plan, it’s working, but it’s not progressing fast enough." Fastensol is one of China's leading suppliers of solar mounting systems has won the trust and good trade reputation of many foreign customers with its high-quality products, excellent R&D design capability, and high standard pre-sales and after-sales service.

Putting solar panels on your roof costs as much as a car, but the cohort of experienced buyers is far, far smaller. Besides that, “This is a big one. This is one where you can’t say, ‘well, if I make a mistake, the next time I’ll know better,’” says Jane Weissman, the president and CEO of the nonprofit Interstate Renewable Energy Council, which just released a consumer checklist and other resources for rooftop solar to consider before making the jump to solar energy. 1. Do you have a roof that can support solar panels? This is pretty key. If your roof is covered in shade most of the day throughout the year, or your roof won’t cut it, or you can’t make the call because you rent your apartment or live in a multi-unit building, looking into shared or community solar would be better choice. This approach lets many different customers buy a stake in a solar installation and receive credits on their electricity bills. If you do have a suitably sunlit rooftop to work with, Weissman says, make sure it’s in good shape structurally, thus you don’t have to pay extra time and money for renovation mounting system during the 20 or 25 years of solar installation warranties. Lastly, envision the future of your yard away from obstructions. Be prepared to prune your foliage to keep the panels clear. 2. Have you done everything you can to improve efficiency? The amount of solar energy you need to produce depends on how much you use, so it makes sense to trim your usage as much as possible before paying for all those panels and Fastensol mounted. Start with an energy audit and look for efficiency upgrades before you draw up blueprints. 3. Which kind of solar makes sense? If your home uses a lot of energy for heating, or you live somewhere where heating fuel is expensive relative to electricity, a solar thermal investment could break even sooner, says the engineer Timothy Wilhelm. But, he adds, solar thermal is rarer for homes, so it might be harder to find a qualified installer. 4. How do you connect to the grid? The details vary depending on where you live, but the principle is that any time you’re connecting with a utility, there are a lot of logistics to sort out. Do you have to pay a fee? How long does it take for the utility to get you hooked up? Once you are connected, how and when will you be credited for the electricity you generate? That refers to net-metering, the practice by which utilities reimburse rooftop solar at the same rate as they charge users for electricity. 5. Is your installer trustworthy? This applies any time you hire someone to come into your home, but solar combines the logistics of a home improvement project with the risks of electrical work. Credentials and references are especially important. “You wouldn’t hire an electrician who had never done electrical work to come into your house and change things around,” says Kelly Larson, an electrical contractor in California with 20 years of experience doing solar installations. And this is a b...

On the back of growing population and economic development around the world combined with rising energy demand among residential, commercial and public services, and transport sector, the global DG Ground-mounted Solar PV market is estimated to witness exuberant growth over the forecast period, i.e., 2020-2028. According to IEA (International Energy Agency), the worldwide energy demand grew by 4% (900TWh) in 2018. In the same year, the estimation of total electricity production across the globe was attained through coal and natural gas, with coal contributing to 25.6% and natural gas with 27.9% of the total production. Additionally, there is a rising demand for clean, sustainable and eco-friendly energy generation due to increased concerns pertaining to rise in CO2 emissions from energy generation. With the rapid growth of industrial and residential sector and increase in demand for heating and cooling from among the global population due to climate change, heavy demand for electricity has arisen from across almost every region in the world which is estimated to increase the demand for energy and contribute to the growth of the market over the forecast period (2019-2028). International Energy Agency (IEA) had stated in its report that the average growth rate of energy consumed globally grew by 2.3% in 2018 and had almost doubled since 2010. It also states that the worldwide energy demand grew by 4% (900 TWh) in 2018. Industrial segment consumed highest amount of energy of about 8945 TWh in 2017 as compared to 8699 TWh in 2016. Additionally, residential sector consumed about 5775 TWh in 2017 as compared to 5680 TWh of energy in the year 2016. Moreover, CO2 emissions arising from production of energy had registered an increase of 1.7% with emission levels of CO2 reaching 33 Gigatonnes. Some of the global players in this DG Ground-mounted Solar PV Market are: Jinko Solar SunPower JA Solar Trina Solar Yingli Canadian Solar Several sectors have witnessed high levels of energy consumption globally, with the industrial segment consuming the highest of about 8945 TWh in the year 2017 as compared to 8699 TWh of energy consumed in 2016.). Moreover, International Energy Agency (IEA) had also mentioned in its report that in 2018, the average growth rate of energy consumption had almost doubled since 2010 and grew by 2.3% in 2018. Additionally, CO2 emission levels arising from production of energy had recorded an increase of 1.7% reaching about 33 Gigatonnes. Many governments across the world have introduced stringent policies and regulations for reducing carbon emissions that is destroying the environment. Fastensol is one of China's leading suppliers of solar mounting systems has won the trust and good trade reputation of many foreign customers with its high quality products, excellent R&D design capability and high standard pre-sales and after-sales service.

In the global energy structure, the penetration rate of solar power generation is relatively low, which prompted an American technical expert to predict that the photovoltaic learning curve will lead to the price of photovoltaic power generation reaching 1-2 US dollars in relatively sunny areas by 2030-2035. Minute. Clean energy investor and technology expert Ramez Naam (Ramez Naam) inferred that the utility-scale solar projects built since 2010 will generate electricity prices will continue for 10 years, and plans to start using before the end of the year. The current price trend of solar panels follows Lai's law, that is, each time manufacturing output doubles, production costs will fall by a fixed 25%. Nahm studied the average cost of global photovoltaic power generation (in addition to the cost of modules), and separately investigated the average cost of India, China and the United States. These costs (except for the cost of modules) accounted for 2/ 2 of the average cost of solar power plants. According to Lai's law, every time the photovoltaic power generation capacity doubles, the price of solar power will drop by 30-40%. The technical expert said: “The price of solar energy is falling faster than anyone including me predicts. The data predicted by modeling shows that the price of photovoltaic power generation will continue to fall faster than expected, and the final price will be Lower than almost everyone’s expectations. By any standard, these prices are crazy enough to change the world’s cheapness.” This price drop will make solar energy cross the tipping point of the energy transition, and the construction cost of new solar projects will be low. The operating cost (marginal cost) of existing fossil fuel power generation facilities, even in the era of extremely low natural gas prices. As of the end of 2019, solar energy accounted for only 2% of the global energy structure. Nam said he expects the learning curve, or experience curve, to develop at the same rate due to the application of Lay's law, and the world will increase at least twice The photovoltaic power generation capacity reaches 2.4 terawatts, which is 8% of the world's electricity demand today. Nahm believes that by that stage, the cost of solar power will be halved from the current level. Namm’s research pointed out: “In sunny areas with low capital, labor and land costs, we can often see unsubsidized photovoltaic electricity prices between 0.01-0.02 USD/kWh.” In California, we may look at To $0.025 per kilowatt-hour of unsubsidized solar energy. In Northern Europe, we can see that utility-scale solar energy is usually priced at $0.04-0.05/kWh. At present, the cost of photovoltaics has been 30-40 years ahead of the International Energy Agency's (IEA) forecast in its 2014 solar technology roadmap, and 7-10 years ahead of the 2015 forecast by Biham in 2015. Only data from Lawrence Berkeley Laboratories and the United States were used. The IEA claimed that it announced possible...